7 Things You Should Know About Paradigm REIT Before Investing

18 May 2025

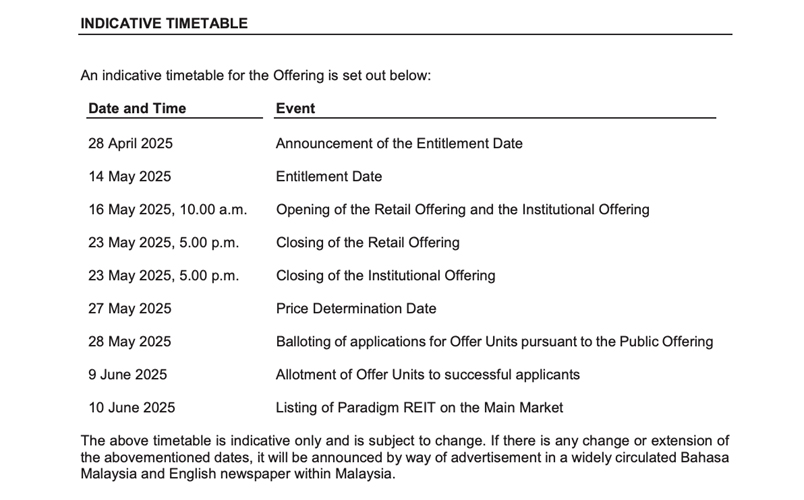

PETALING JAYA, 18 MAY 2025 - On 16 May 2025, Paradigm REIT had officially released its IPO Prospectus and opened its units to the public for subscription. It includes three retail properties in its initial portfolio, which include Bukit Tinggi Shopping Centre (BTSC), Paradigm Mall PJ, and Paradigm Mall JB. Presently, their total valuation is RM 2.437 billion. The subscription of its IPO units would end on 23 May 2025 & be listed on Bursa Malaysia on 10 June 2025.

Source: Paradigm REIT’s IPO Prospectus

In this article, I’ll make a list of 7 things which I had learnt after reading its IPO Prospectus.

They are as follows:

1. Property 1 – Bukit Tinggi Shopping Centre (BTSC)

BTSC is a freehold 3-storey neighbourhood mall located in Klang worth RM 680 million.

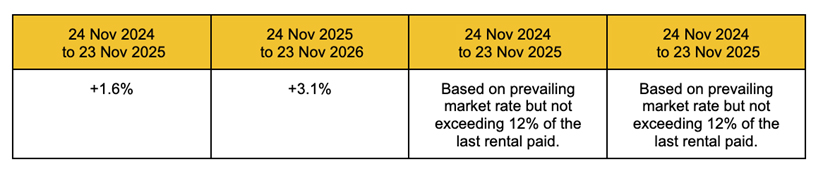

Paradigm REIT leased BTSC solely to AEON for a period of six years, which had begun from 24 November 2023 to 23 November 2029. This rental agreement comes with fixed rental escalation with an option to renew upon lease expiry on 23 November 2029. The fixed rental escalation set is as follows: Paradigm Mall PJ is a six-level retail complex located at Petaling Jaya, Selangor. It is visible and highly accessible from the LDP. Surrounded by matured residential areas, office and commercial buildings, Paradigm Mall PJ enjoys footfall from both residents and office crowds in the vicinity.

The property is leasehold, expiring on 9 February 2111. It is valued at RM 600 million. This retail mall is 97.9% occupied by 273 tenants, where its 10 biggest tenants contributed 19.5% of Gross Rental Income (GRI). These tenants include:

AEON, as its sole tenant, runs its retail operations and sub-leases other retail spaces to tenants, which include OLDTOWN, BananaBro, Adidas, and Sushi Zanmai.

In addition to the lease granted to AEON, Paradigm REIT earns additional revenues from its car park facilities, including premium parking valet services and organising events such as bazaars, food festivals and outdoor gatherings.

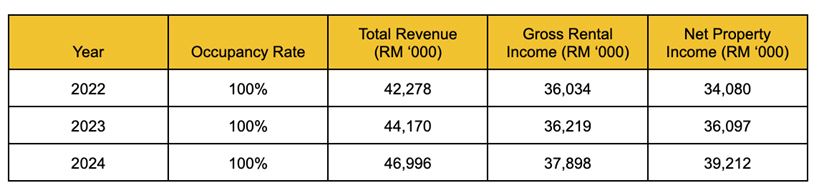

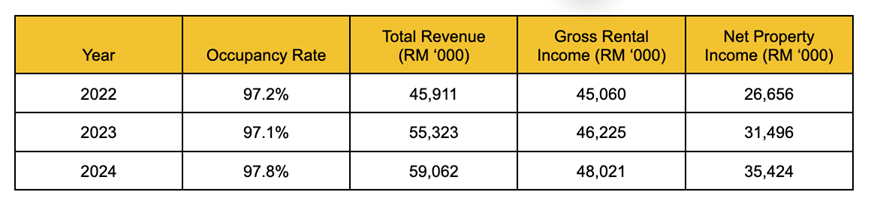

In the last three years, BTSC generated the following revenue and net property income (NPI):

2. Property 2 – Paradigm Mall PJ

Paradigm Mall PJ is a six-level retail complex located at Petaling Jaya, Selangor. It is visible and highly accessible from the LDP. Surrounded by matured residential areas, office and commercial buildings, Paradigm Mall PJ enjoys footfall from both residents and office crowds in the vicinity.

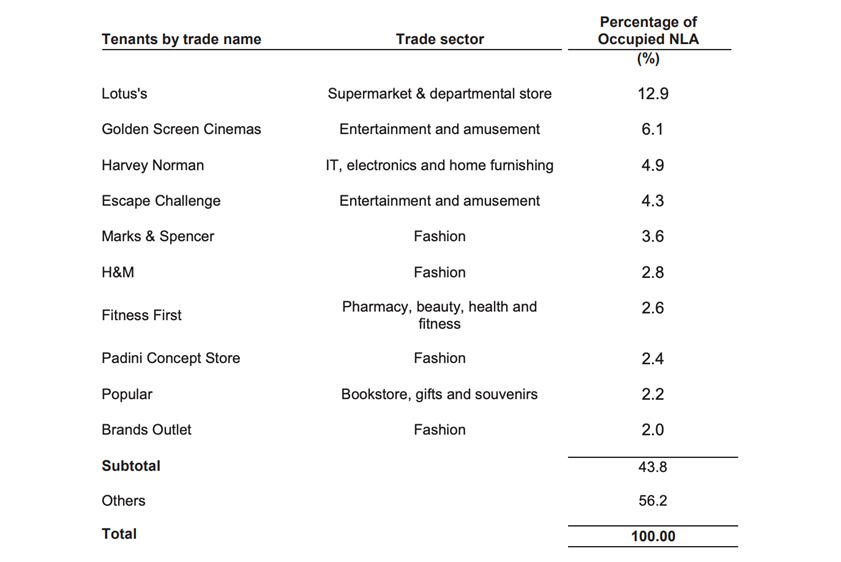

The property is leasehold, expiring on 9 February 2111. It is valued at RM 600 million. This retail mall is 97.9% occupied by 273 tenants, where its 10 biggest tenants contributed 19.5% of Gross Rental Income (GRI). These tenants include:

Source: Paradigm REIT’s IPO Prospectus

Over the last three years, Paradigm Mall PJ generated the following revenue and NPI:

The occupancy rate in the table refers to the average occupancy rate

3. Property 3 – Paradigm Mall JB

Paradigm Mall JB is a freehold megamall opened in 2017 in Johor Bahru worth RM 1.16 billion.

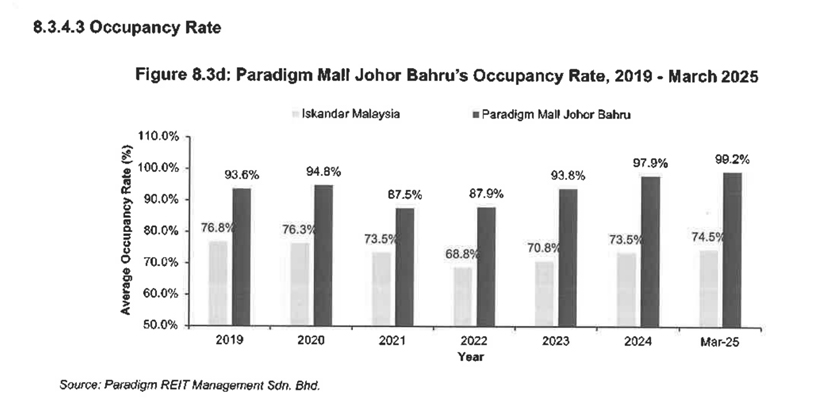

It is situated within a 15-minute drive from CIQ complex and 10-minute drive from JB city centre, which has direct access to highways namely Skudai Highway, Pasir Gudang Highway, the North South Highway and Second-Link Expressway. Since COVID-19, Paradigm Mall JB improved the level of occupancy rate from 87+% in 2021-2022 to 99.2% in March 2025.

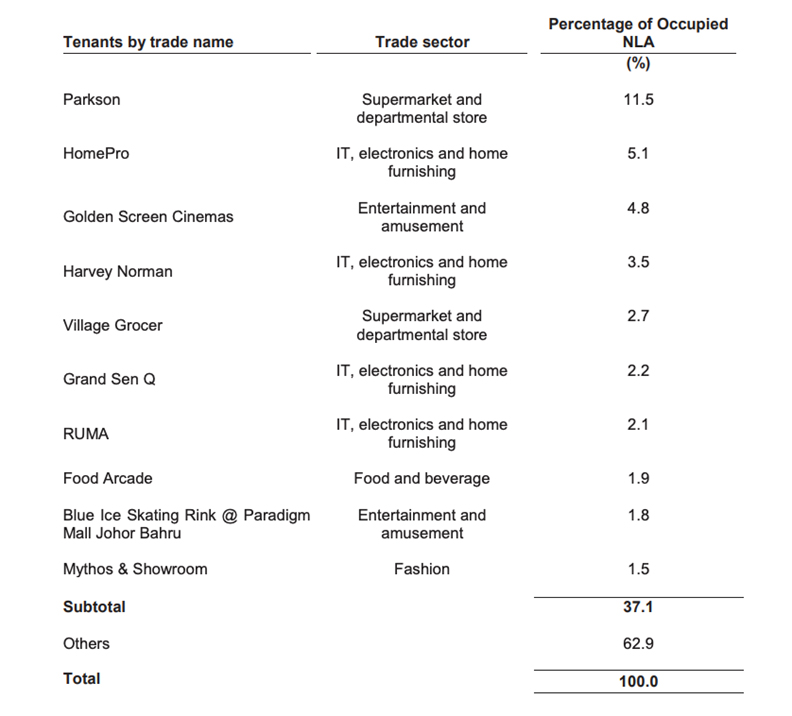

Paradigm Mall JB has a tenant pool of 449 tenants. Its top 10 tenants have contributed 17.9% of its GRI. These tenants are as follows:

Source: Paradigm REIT’s IPO Prospectus

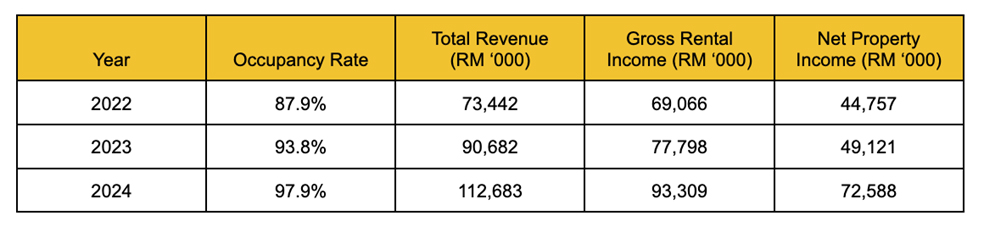

Over the last three years, Paradigm Mall JB generated the following revenue and NPI:

The occupancy rate in the table refers to the average occupancy rate

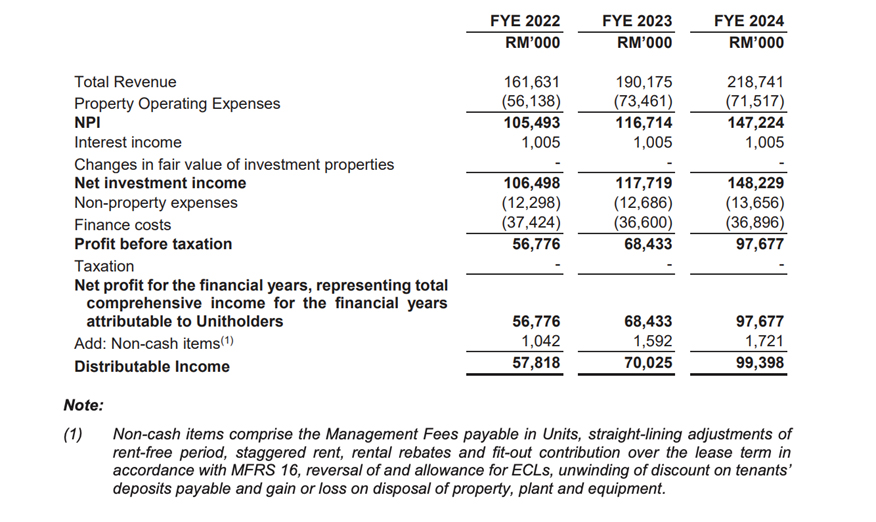

4. Financial Results

Paradigm REIT has four different sources of revenues: rental income (base rent and percentage rent based on tenants’ gross turnover), car park rental, advertising and promotional income, and other income (rental arrears, forfeiture of deposits, car park clamping fees and fit-out fees).

In 2024, 83% of its revenues are derived from rental income. 11% were derived from its car park income while the remaining 6% are earned from advertising, promotional and other income.

In the last three years, these properties combined generated higher revenues as they generated improved rental income, car park income, advertising and promotional income during the period. Revenue has grown from RM 161.6 million in 2022 to RM 218.7 million in 2024. This contributed to a growth in distributable income from RM 57.8 million in 2022 to RM 99.4 million in 2024.

Of course, this assumes how its distributable income might have been if it existed earlier.

5. Gearing Ratio

Based on its pro-forma financial position, Paradigm REIT has RM 841.7 million in borrowings. In comparison to its total asset value (TAV) of RM 2.48 billion, its initial gearing ratio is 34.0%. This is lower than the maximum allowable gearing ratio of 50%. The weighted average indicative rate of its debt (medium-term note) is 4.44% per annum.

6. Sponsor and ROFR Properties

WCT Holdings Bhd is the sponsor and largest unitholder of Paradigm REIT. Upon listing, WCT Holdings will own 60.7% unitholding of Paradigm REIT. Tan Sri Lim Siew Choon is an indirect substantial unitholder of the REIT with his direct and indirect shareholdings, totalling 23.24% stake of WCT Holdings Bhd.

WCT Holdings Bhd is a listed construction, property development and investment company. The company also owns 80% stake in Paradigm REIT Management Sdn Bhd, the REIT’s manager.

WCT Holdings Bhd has granted a Rights of First Refusal (ROFR) to Paradigm REIT to purchase any of its relevant assets to grow its property portfolio. Today, WCT Holdings Bhd owns a couple of real estate which include:

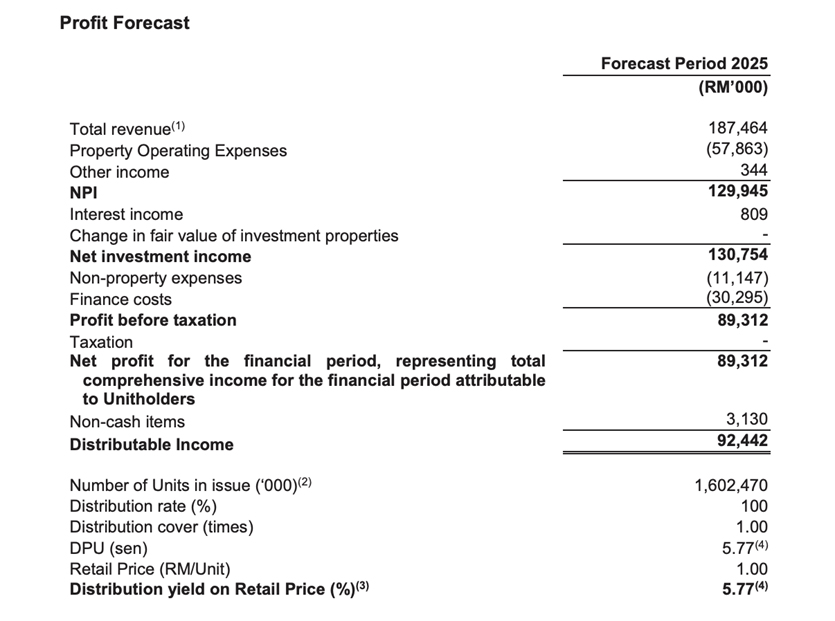

7. Initial Distribution Yield

Paradigm REIT had provided a profit forecast, where it expects to generate RM 92.442 million in distributable income from 13 March 2025 (Date of acquisition of Paradigm REIT on its three mall properties) to 31 December 2025. Its annualised Distribution Per Unit (DPU) is 7.16 sen. Hence, based on its IPO offering of RM 1.00 per unit, its initial distribution yield works out to be 7.16% a year, assuming that it has an income distribution rate of 100%.

Source: Paradigm REIT’s IPO Prospectus

Paradigm REIT adopts a distribution policy where it would distribute at least 90% of distributable income to unitholders on a half-yearly basis: 1 January to 30 June and 1 July to 31 December in each year.

Conclusion:

From its IPO Prospectus, I’d discovered that Paradigm REIT is starting out with three properties, which are enjoying a combined occupancy rate of 99.0%. These properties have increased their revenues and net property income in 2022-2024. WCT Holdings Bhd would remain as the major unitholder of both Paradigm REIT and its manager, Paradigm REIT Management Sdn Bhd. As a sponsor, it granted Paradigm REIT the ROFR to purchase any of its relevant assets in the future and thus, may contribute to its portfolio growth (when such acquisitions arise).

Click

here to read the original article from Business Today.